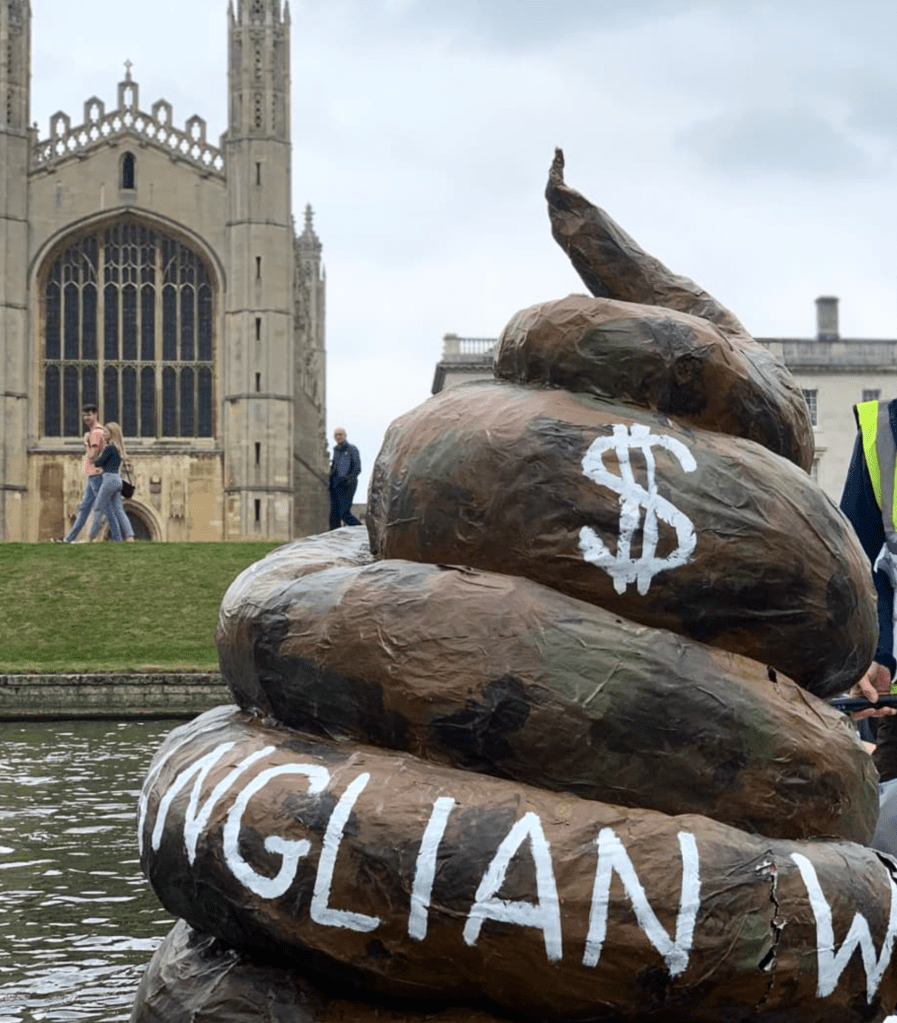

Anglian Water announced its consecration as “Utility of the Year” last week. Chief Executive Peter Simpson observed that the award reflected their “leadership in environmental protection”. I hope Peter and Anglian Water will forgive me for being somewhat bemused, as this announcement was followed by the publication of the industry’s annual returns of storm overflows. That’s code for saying how much raw sewage escapes into our rivers and seas. Which is a lot.

In 2020, across its network, Anglian showed 17,428 separate incidents of the escape of raw sewage for a total of 170,547 hours. That’s nearly 20 years of poo entering our rivers and around 5.5% of the industry total. The new figures indeed show awarding-winning progress, with 21,351 incidents (up 22.5%) for a total of 194,594 hours or 22.2 years of flowing excrement, and a market share of 7.3%.

How has it come to this? Perhaps a perfect storm of weak and resource-starved regulation and lack of public awareness, (although the kraken that is public opinion is slowly waking). More likely however is a systematic underinvestment in infrastructure and leak repair by the water companies, who are generally run under financial strategies designed to maximise shareholder return at the expense of environmental benefit. A quick look at the Anglian Water shareholder base shows global pension schemes, sovereign and institutional investors who may not see the preservation of local chalk streams as important daily business.

The shareholders in Anglian Water Group Limited, the ultimate parent company, are as follows:

32.9%: CPP Investments of Canada, the Canadian Pension Plan which has c. 20 million contributors and beneficiaries, or 53% of the population of Canada.

19.8%: IFM Global Infrastructure Fund, an Australian fund manager managing the pensions of 120 million people in Australia and elsewhere.

16.7%: Infinity Investments, owned by the state of Abu Dhabi, who also own Manchester City FC.

15.6%: First Sentier, an Australian institutional and pension fund investor.

15.0%: Camulodunum, jointly owned by Dalmore (1.3 million UK pension holders) and GLIL, the pensions arm of Greater Manchester, Merseyside, West Yorks and the Local Pensions Partnership. (By way of digression, Camulodunum was the capital of Roman Britannia taken out by Boudicca in 61AD. I can’t help thinking that things would be somewhat different if she were head of the Environment Agency.)

These are the owners who seemingly tolerate the increasing pollution of the chalk stream infrastructure of the Cam. To bring matters closer to home, we might look at the recently published statistics for the storm tanks in Haslingfield (which discharges into the Rhee and then the Cam), Melbourn (which discharges into the Mel, the Rhee and then the Cam) and Barrington (into the Rhee and then the Cam). For any geographically challenged shareholders, this is less than four miles from Grantchester Meadows (once a popular location for wild swimming) and five miles from King’s College.

In 2020, the plant at Haslingfield recorded 49 overflow incidents for a total of 428 hours (17.8 days of flowing sewage). The newly-published figures for 2021 show 82 incidents (+67%) for 1,013 hours (42 days, up 137%).

The figures for Melbourn show 62 incidents for 93 hours (3.9 days) in 2020, rising to 80 leaks for 216 hours (9 days, up 123%).

The Barrington site shows a similar pattern of increase with 4 incidents for 16 hours in 2020, rising to 12 for 20 hours in 2021.

With this rising tide of pollution, it is perhaps unsurprising that the Environment Agency announced in September 2020 that not a single lake or river in England could be classed as “Good” in 2019, down from 16% in 2016. This is despite its own target that all waters should be in good health by 2027. This problem of pollution is exacerbated by the lower flows resulting from overabstraction by other water companies, but that’s a story for another day.

By way of further digression, the WWF makes the following observation: “Some of our most beautiful rivers are ‘chalk streams’. Their pure, clear, constant water from underground chalk aquifers and springs, flowing across flinty gravel beds, make them perfect sources of clean water – and ideal for lots of wild creatures to breed and thrive. We’re lucky because the majority of the world’s chalk streams are found in England.”

Pure, clear water? Not with 52 days of raw sewage into the Cam in 2021.

It’s hard to avoid the conclusion that systematic underinvestment is responsible for what appears to be a worsening situation. Anglian Water will doubtless point to annual network investment of £339 million. Others might point to the dividend of £68 million in 2020 and a proposed dividend of £96 million (plus any other internal financing that may exist to extract value). Although these appear to go towards group debt repayment rather than to the ultimate shareholders, they still diminish the ability of the principal operating subsidiary to invest in its network and still enhance shareholder value. A stronger regulator might wish to limit future dividend payments and executive incentives until substantial improvements can be shown, as pollution fines of £1.4 million in 2021 seem more of a minor occupational irritation than a meaningful disincentive.

What to do?

1) Resource and strengthen the Environment Agency and OfWat.

2) Regulate for serious and accountable pollution reduction plans, with allowable returns directly linked to measurable improvement in water quality.

3) (And arguably the most effective and accessible approach) Use our power as electors to weaponise river pollution as a major political issue requiring urgent action. The Chesham & Amersham by-election in June 2021 recorded a 30% swing against the incumbent following concern about local issues. What better way to focus the minds of our elected representatives?

A day of reckoning must surely come. In the meantime, we can doubtless take consolation in the fact that every passing poop in the Cam is supporting pensioners worldwide and, above all, Manchester City.

Let’s raise a glass (not Cam water, obvs) to the utility of the year!

Image courtesy Little Blue Dot